For the agency theory when information are asymmetric the disciplinary mechanisms of governance have a moderating effect on the remuneration policy and consequently the This article studies the links between governance and risk-taking in banks. Separation of goals between wealth maximisation of shareholders and the personal objectives of managers.

Findings Of Studies Relevant To Shareholder Vote On The Remuneration Policy Download Table

The shareholders true owners of the corporation as principals elect the executives to act and take decisions on their behalf.

. This theory which explains the relations between owners and managers needs to be revisited in the light of current debates on the performance of companies and the remuneration of. This new book examines the relationship between agency theory and executive pay. Employers and employees are the two stakeholders of a business unit the former assuming the role of principals and the latter the role of agents.

As the share of all income going to the top 1 percent has risen over the past four decades so has the share of top incomes coming from labor income relative to capital income. Drawing on ideas from economics psychology sociology and the philosophy of science the author explains how standard agency theory has contributed to the problem of executive pay rather than solved it. Fair is about paying a reasonable market price for the services youve contracted taking into account your scope of work and allowing the agency to make a fair and reasonable profit for the work they do.

This separation is a key assumption of agency theory. The rise in labor income is mainly due to the explosion. It argues that while Jensen and Meckling 1976 were right in their analysis of the agency problem in public corporations they were wrong about the proposed solutions.

Katsos 21 Introduction 21 Agency Theory and Managerial Compensation 23 Base Salary 26 Bonus 26 Stock Options 27 Employee Motivation 29 Current. Management and Collective Production 16. The agency theory which was first proposed by Jensen and Meckling 1976 suggests how to solve the agency problems and associated costs.

It relates to a specific type of agency relationship that exists between the shareholders and directorsmanagement of a company. By George-Levi Gayle Chen Li and Robert A. Agency theory addresses the problems that face the business.

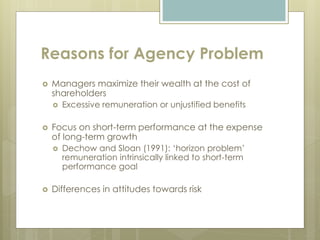

The agency theory focuses on the divergent interests and goals of the organizations stakeholders and the way that employee remuneration can be used to align these interests and goals. Divorce between ownership and control linked with differing objectives creates agency problems. It argues that while Jensen Meckling 1976 were right in their analysis of the agency problem in public corporations.

Possible short-term perspective of managers rather than protecting long-term shareholder wealth. A firms owners are called the principals and the hired executives are called the agents. Drawing on ideas from economics psychology sociology and the philosophy of science the author explains how standard agency theory.

Agency theory in corporate governance is an extension of the agency theory discussed above. The first significant theory looks upon executive remuneration as a performance contract between the owner principal and the executive agent called the Agency theory Ross 1973. The agency theory focuses on the divergent interests and goals of the organisations stakeholders and the way that employee remuneration can be used to align these interests and goals.

Agency theory studies the problems and solutions linked to delegation of tasks from principals to agents in the context of conflicting interests between the parties. In this theory one party the principal hires another the agent who possesses specialized skills and knowledge. Up to 10 cash back The Remuneration Committees Dilemma.

Accounting finance economics law political science strategy or organizational psychology. The aim is to represent the views of the. Agency Theory and Executive Pay Authors.

There are various theories in understanding remuneration out of which three different theories will be discussed as follows. How Well Does Agency Theory Explain Executive Compensation. The book explores why companies should.

However these policies could plausibly lead to risk taking by management in excess. The psychological contract theory. Incomplete Remuneration Contracts 9 Agency Theory 11 Adverse Selection 13 Moral Hazard 14 Different Agency Conflicts 15 v.

Braendle and John E. According to this theory organisations attempt to maintain particular salary differentials between the management and subordinate levels to comply with. Agency theory is used to understand the relationships between agents and principals.

Agency theory may be considered as a theoretical extension of managerialism. The agent represents the principal in a particular business transaction and. Employers and employees are the two stakeholders of a business unit the former assuming the role of principals and the latter the role of agents.

Approaching agency remuneration solely from the perspective of getting the lowest price is a sure way to getting your agency relationship off on the wrong foot. Beginning from clear assumptions about rationality contracting and informational conditions the theory addresses problems of ex ante hidden characteristics as well as ex post information asymmetry hidden action and examines conditions. The agency theory has interested several disciplines.

THEORY OF REMUNERATION. The book examines the relationship between agency theory and executive pay. Providing a general explanation for executive remuneration.

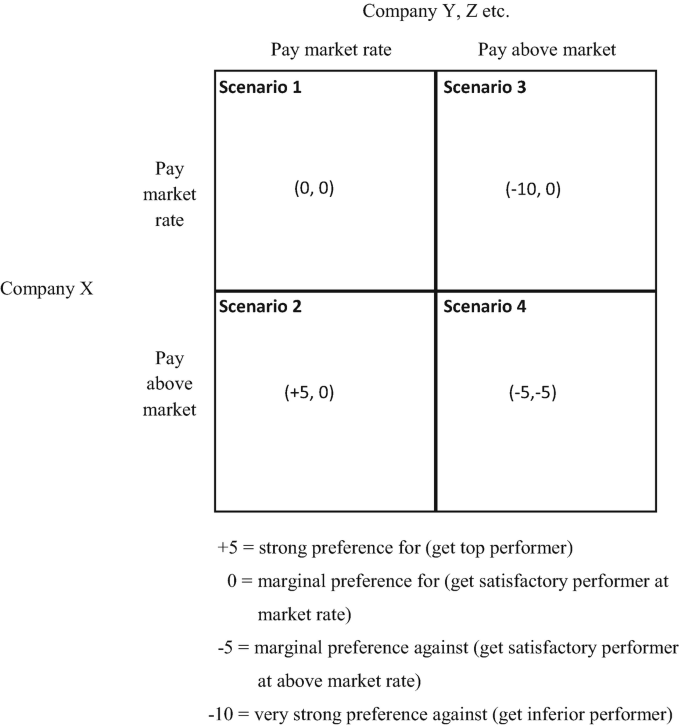

The Second theory finds its nature in aspects executive behavior and argues that the power of the. Explained in A Theoretical Justification of Agency Costs above relating remuneration to output or performance is a useful mitigant of agency costs and serves to align shareholder and employees utility functions.

Agency Costs Coordination Problems And The Remuneration Committee S Dilemma Springerlink

What Are The Theories Of Compensation Business Jargons

An Analysis Of The Impact Of Remuneration On Employee Motivation A Case Study On Unilever Bangladesh

An Analysis Of The Impact Of Remuneration On Employee Motivation A Case Study On Unilever Bangladesh

3 Univariate Analysis Of Differences In Director Remuneration Board Download Scientific Diagram

What Is Remuneration Definition Examples Video Lesson Transcript Study Com

Which Came First Ceo Compensation Or Firm Performance The Causality Dilemma In European Companies Sciencedirect

Findings Of Studies Relevant To Frequency Of Remuneration Committee Download Table

Henri Fayol S 14 Principles Of Management Have Been A Significant Influence On Modern Management Theory His Practical List Of Principles Helped Early 20th Ce

Hr Advisor Human Resources And Recruiting Wordpress Theme Human Resources Human Resource Management Recruitment

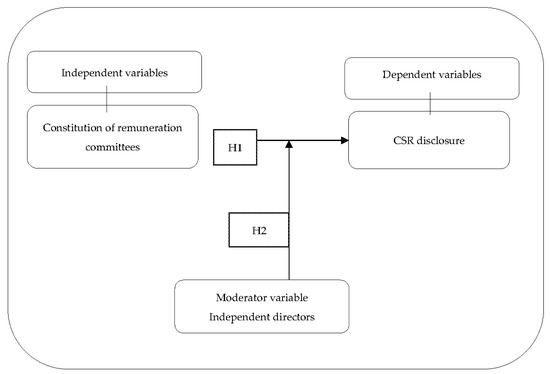

Sustainability Free Full Text How Do Remuneration Committees Affect Corporate Social Responsibility Disclosure Empirical Evidence From An International Perspective Html

Pdf Corporate Governance And Executive Remuneration A Contingency Framework Semantic Scholar

Agency Costs Coordination Problems And The Remuneration Committee S Dilemma Springerlink

Organizational Change Management Google Search Change Management Change Management Quotes Management

Marketing Consultant Contract Template Luxury 13 Marketing Consulting Agreement Samples Contract Template Marketing Consultant Social Media Marketing

Pdf Agency Theory And Corporate Governance A Review Of The Literature From A Uk Perspective Semantic Scholar